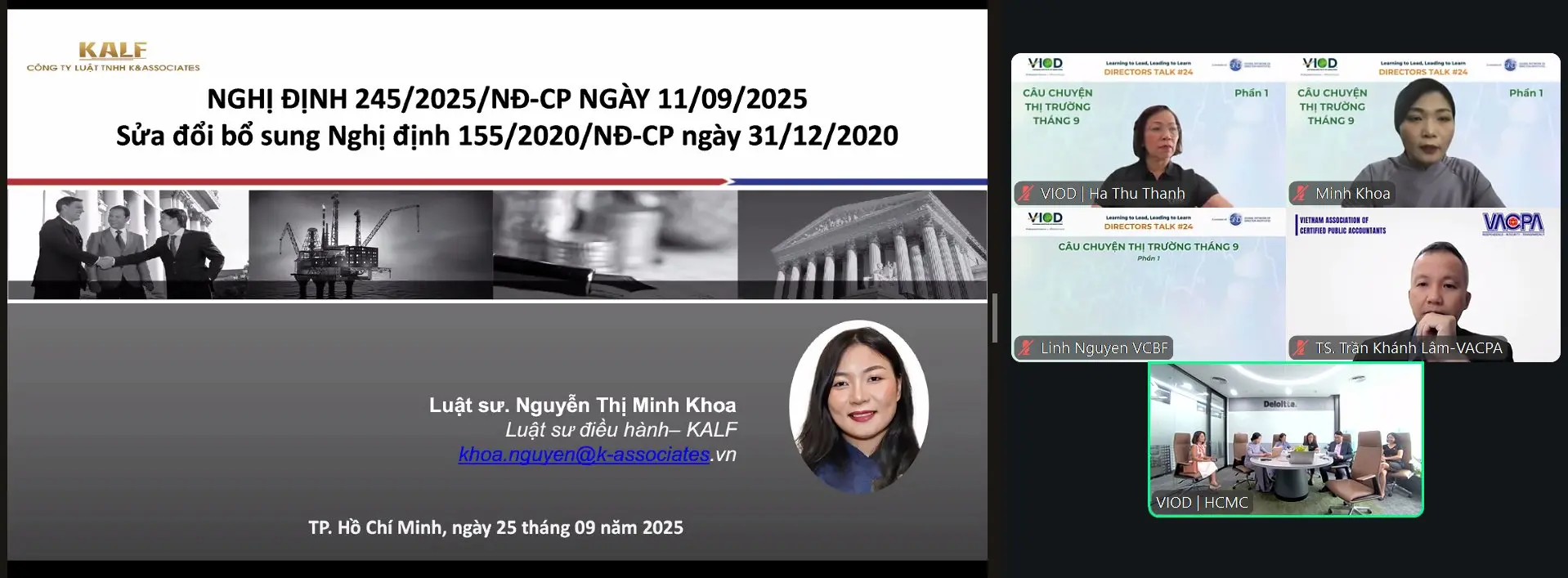

On September 25, 2025, the Vietnam Institute of Directors (VIOD) successfully hosted Directors Talk #24: “Vietnam Market Outlook – September Highlights”, gathering representatives from market regulatory bodies, investment funds, and over 100 board members, corporate leaders, and market experts. The session spotlighted key legal developments, including Decree No. 245/2025/ND-CP amending and supplementing Decree No. 155/2020/ND-CP (guiding the implementation of the Law on Securities), and Decision No. 2014/QS-TTg approving the National Roadmap for Stock Market Upgrade. These two legal instruments represent a significant stride in strengthening Vietnam’s capital market framework. They reaffirm Corporate Governance as a cornerstone of sustainability and a critical driver enabling enterprises to withstand challenges, foster long-term growth, and enhance their global competitiveness.

Decree No. 245/2025/ND-CP introduces several key changes, including tighter regulations on dual roles, increased accountability of the Board of Directors in dividend distribution and independent directors’ reporting, clearer rules on foreign ownership limits, and shorter timelines for IPO and listing processes. Meanwhile, Decision No. 2014/QS-TTg marks a major milestone, emphasizing the adoption of International Financial Reporting Standards (IFRS) and the advancement of Corporate Governance practices aligned with OECD principles.

Ms. Pham Thi Thuy Linh, Head of the Securities Market Development Department at the State Securities Commission (SSC), highlighted: “These two legal documents will have a significant impact on the stock market. The new regulations are driving enterprises toward stronger Corporate Governance practices and improved disclosure – changes that will not only strengthen individual companies but also foster the sustainable development of the capital market as a whole.”

From an institutional investor’s perspective, Mr. Nguyen Hoang Linh, Director of Research at Vietcombank Fund Management (VCBF), shared: “Market upgrade does not automatically guarantee an inflow of foreign capital. What truly attracts investors is the availability of high-quality assets – companies that demonstrate transparent governance, adherence to international standards, and strong risk management. We have declined investment opportunities in firms with solid financials but weak governance. Sustainable investor confidence can only be achieved when market upgrade goes hand in hand with advancements in corporate governance and ESG practices.”